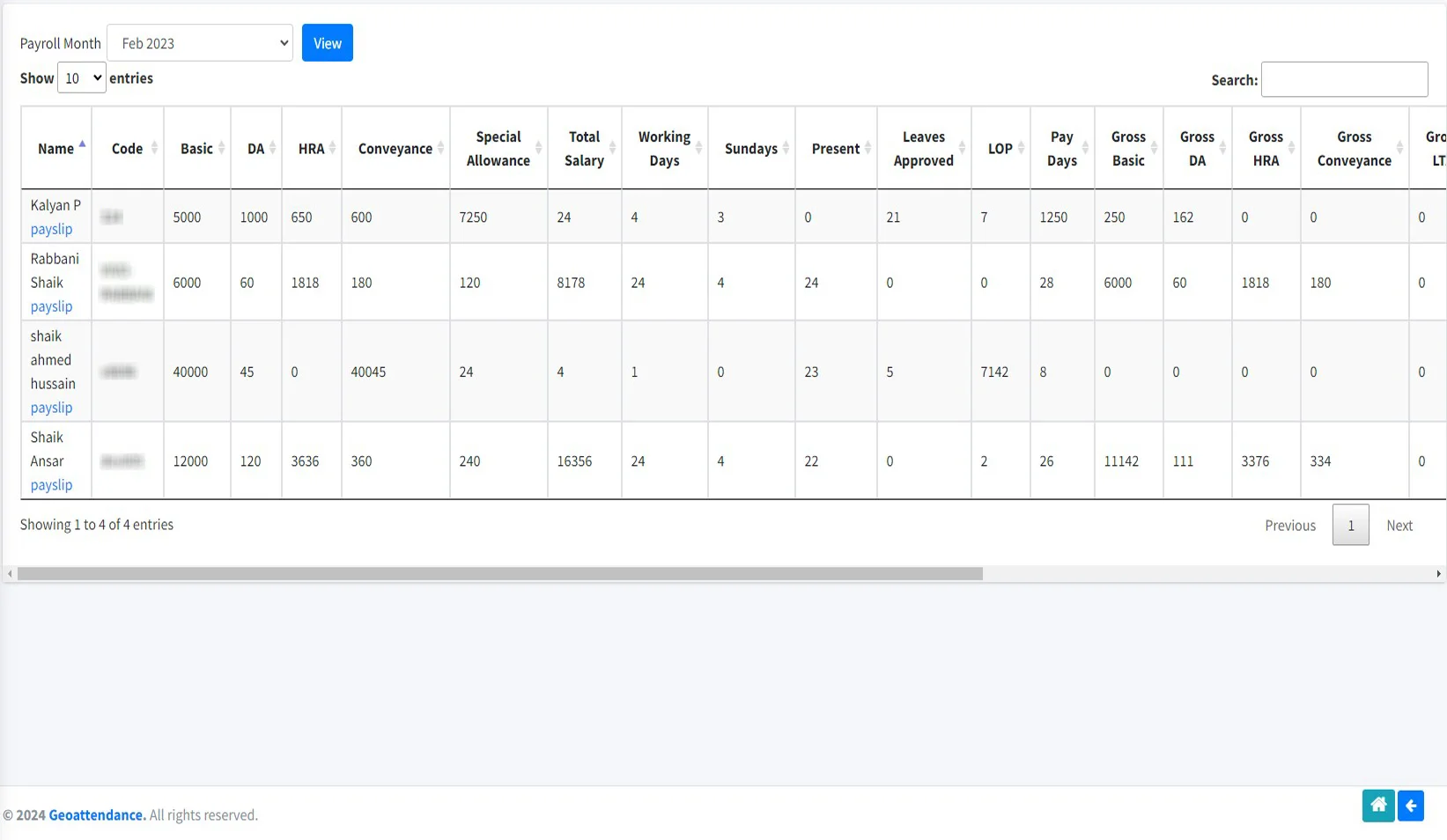

Features like automatic tax calculations, deductions, and overtime calculations save time and reduce errors associated with manual calculations.

Integration with time-tracking systems automates the process of calculating hours worked, reducing errors and ensuring accurate pay

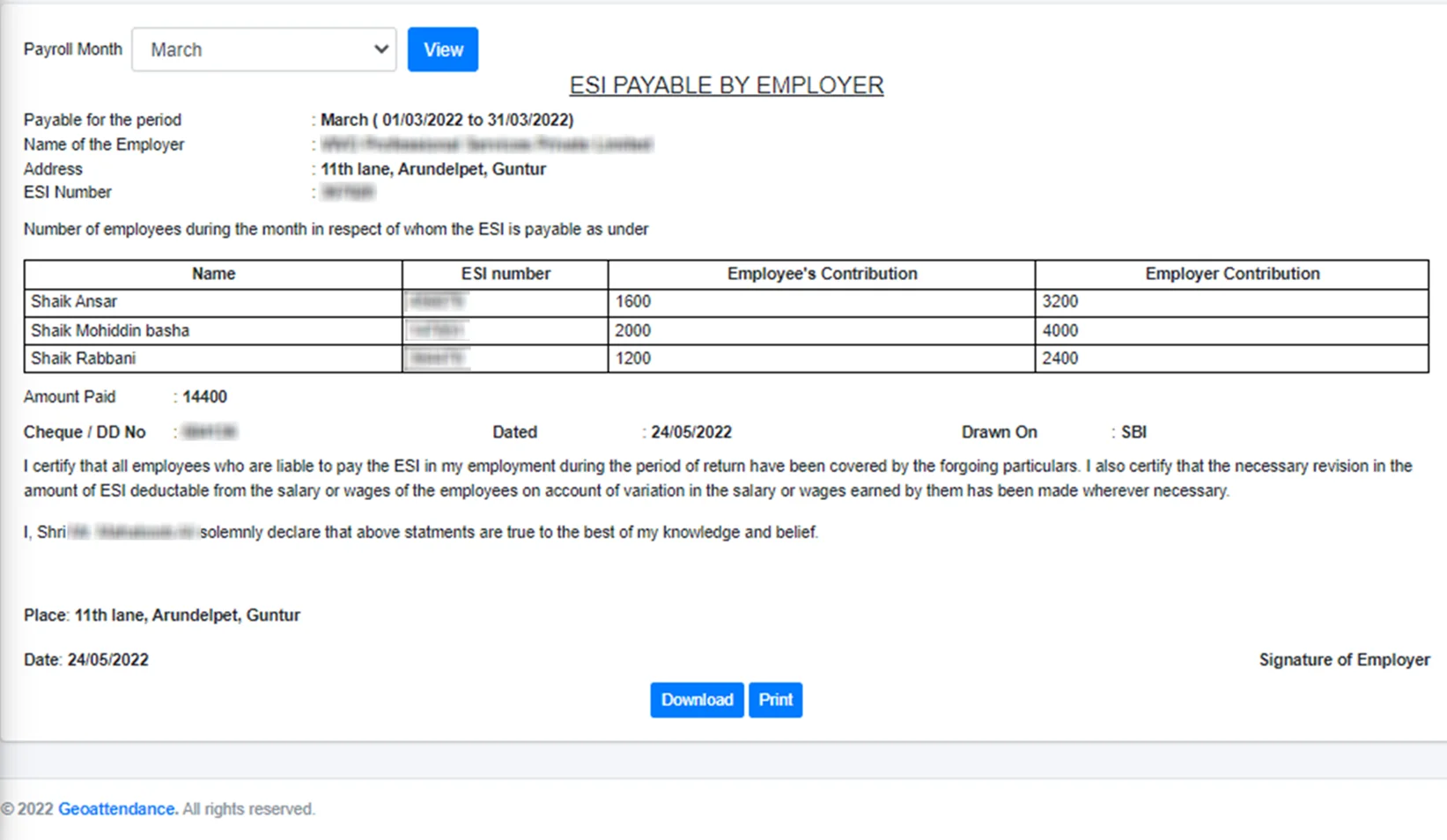

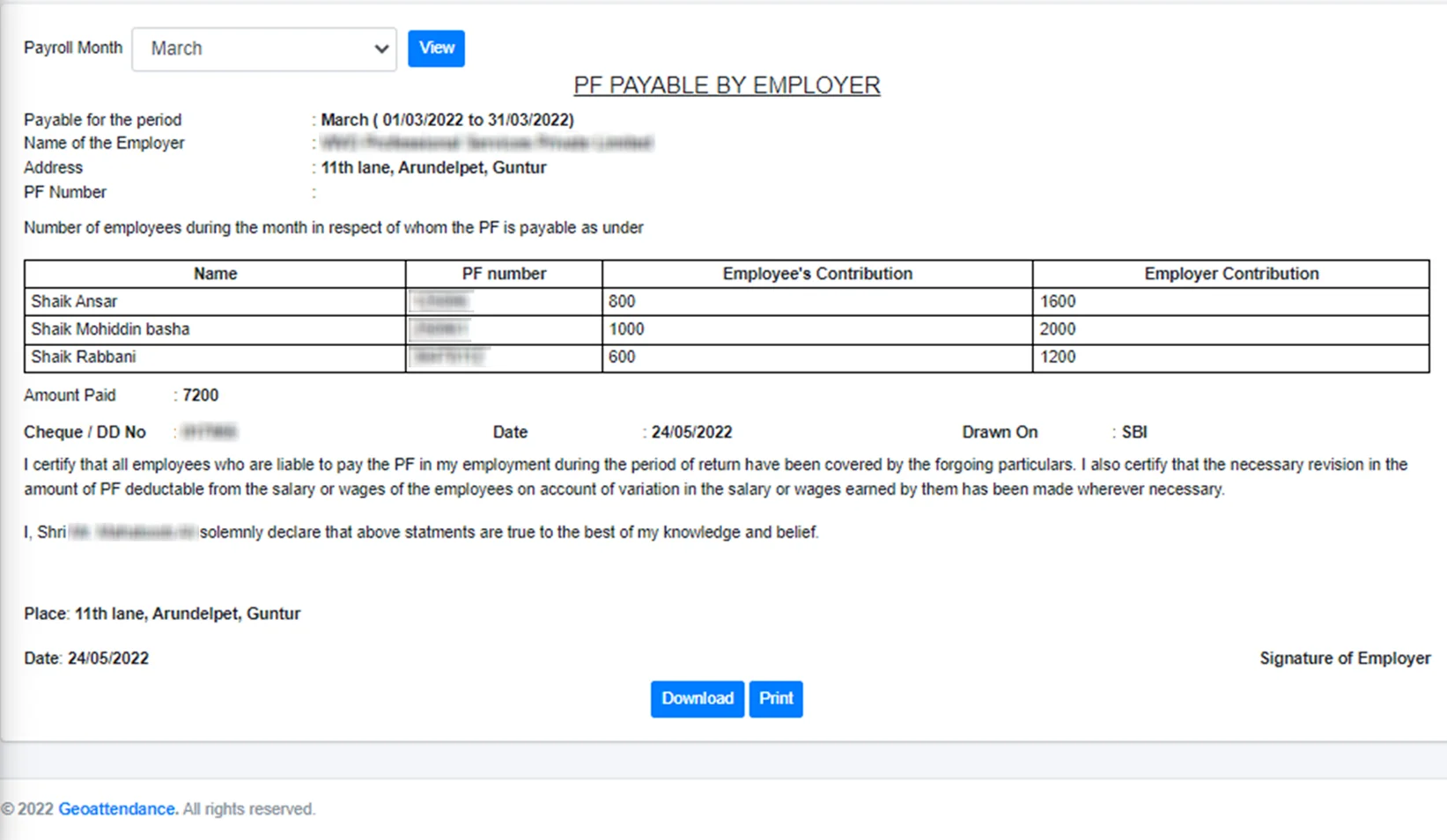

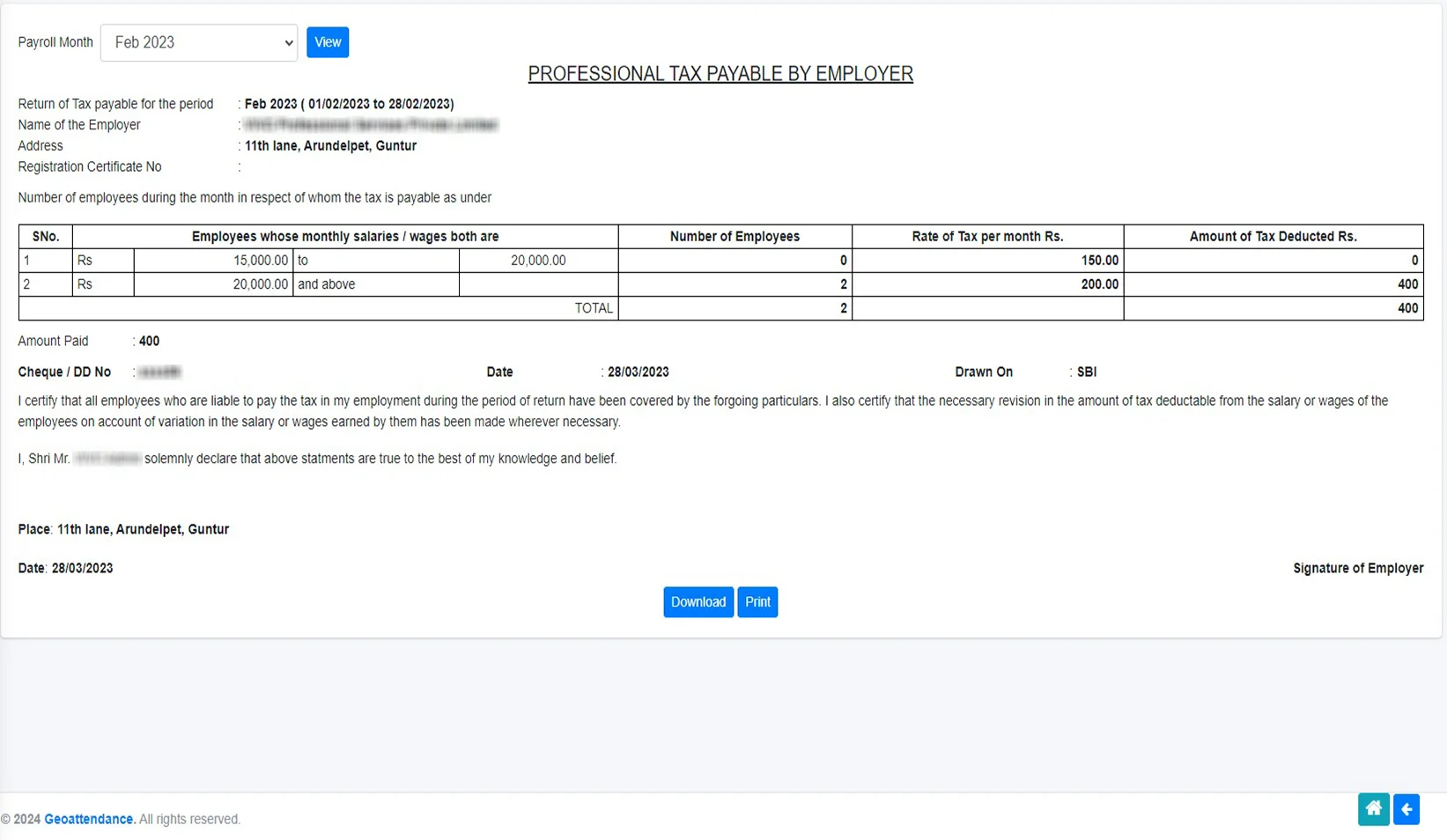

Built-in tax tables and compliance features ensure accurate tax deductions and filings, reducing the risk of penalties or fines for non-compliance.

Allows employees to access their pay stubs, tax documents, and other relevant information, reducing HR's workload and empowering employees with self-service capabilities.

Provides customizable reports on various payroll metrics, facilitating better insights into labor costs, tax liabilities, and other financial aspects.

Automation reduces the time spent on payroll processing, allowing HR staff to focus on strategic initiatives and other critical tasks.

Reduces the likelihood of errors in calculations, tax filings, and compliance, minimizing the risk of penalties and legal issues.

Streamlined processes and reduced manual intervention lead to increased efficiency across the payroll management workflow.

Self-service options and timely, accurate pay contribute to higher employee satisfaction and morale.

Payroll systems can scale with the growth of the organization, accommodating changes in the workforce size and complexity.

A payroll management system is software designed to manage, streamline, and automate payroll processes, including employee payments, tax calculations, and record-keeping.

Benefits include increased accuracy, time savings, compliance with tax laws, enhanced security, and better record management.

Yes, most systems can manage various pay schedules such as weekly, bi-weekly, and monthly.

Challenges include staying compliant with changing tax laws, handling payroll for remote employees, and ensuring data security.

Accurate and timely payroll boosts employee satisfaction by ensuring they are compensated correctly and on time.

Yes, many businesses choose to outsource payroll management to specialized firms to save time and reduce errors.

Yes, most payroll software includes direct deposit functionality to transfer wages directly into employees’ bank accounts.

Yes, there are solutions available for small, medium, and large businesses, with scalable features to meet diverse needs.

Reputable software providers regularly update their systems to comply with new tax laws and improve functionality.

Reputable services use encryption, secure servers, and regular audits to protect sensitive payroll information.